股市的坏人多

幸好A股市场牢牢掌握在我们自己的手中。不然,真不知道多少人会骂外国敌对势力的操纵。

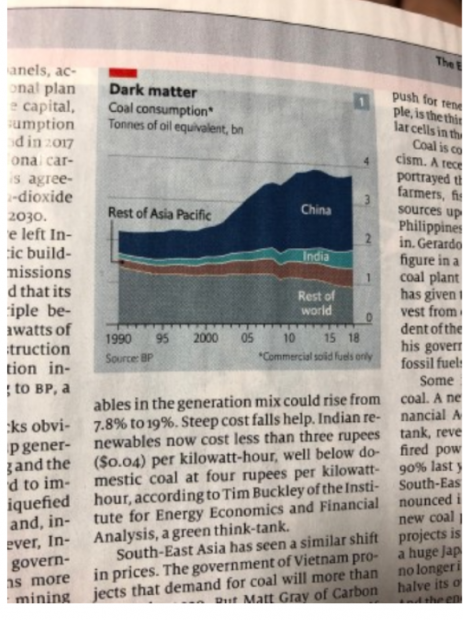

环保人士都爱批评中国烧煤太多。这很不公平。

中国生产的大量产品销往欧美,所以中国人实际上是代欧美烧煤。中国高煤耗的罪魁祸首是欧美人对消费品的痴迷。

见我的领英文章。

China burns coal for the West.

It is fashionable to blame coal, and blame China for its coal consumption. But since China produces many consumer goods for the West, is China not burning coal on behalf of the West?

It is the...

Getting used to a debt crisis!

By Joe Zhang

Mckinsey says that Asia is probably sliding into a debt crisis 22 years after the last one.

I have to disagree, at least as far as China is concerned. China has already been in a debt crisis for at least two years. Mass corporate defaults are commonplace; the leasing sector has been virtually wiped out; eight thousand microcredit firms have been k...

我们可以掌握这样几个标准:

(1)上市公司纷纷回购股票,不是装模作样地回购,而是大幅度回购,穷其资源回购。

(2)大股东们纷纷增持股票,不是装模作样地增持,而是大幅度增持,穷其资源增持。

(3)新股发行被大量的公司主动叫停,而不是被政府叫停。最好看到这种状况:几乎所有的公司都对IPO失去兴趣,撤回申请,而政府只好做拟上市公司的工作,施加压力,逼他们看在国家利益的份儿上申请IPO。最好看到政府部门动员党员董事长们起模范带头作用。

摘自: 《股民的眼泪》,作者:张化桥,中国人民大学出版社

“GE,美国通用电气的假帐比安然Enron还大。GE正在破产之中”,独立调查员Harry Markopolos的报告声称。GE的股价立刻跌了15%。GE称此君”胡说,只是操纵市场而已”。

有人称此君为”美国的张化桥”,他在麦道夫出事之前曾多次警告监管当局。

见英国金融时报头版。《南华早报》长文,顺便分析四大资产管理公司的核心角色。

China is slowing gracefully …

South China Morning Post, 14 Aug, 2019.

For four decades, China has seemed like an overly energetic start-up company. It has always had ambitious targets, from the “Four Modernisations” to “Quadrupling National Income” and “Made in China 2025”.

Now, it seems, “slogan fatigue” is setting in and of...